Drive profitable growth with trusted data.

Transform experiences for customers, agents, and employees with our AI-powered insurance-specific solution. Unify, manage and mobilize your data within 90 days.

Trusted by 29 of the Fortune 500.

Move from policy centricity

to customer centricity.

experience.

efficiency.

and compliance.

data.

IT efficiency.

Build loyalty with trusted client, policy, and claims data.

Know your customers and their end-to-end journeys, relationships, life events, and buying patterns. Deliver frictionless, omnichannel experiences based on trusted client, policy, broker, and claims data across your enterprise systems.

So you can exceed customer and broker expectations every day and build loyalty as you increase upsell/cross-sell.

Boost productivity with real-time client insights.

Reduce manual data efforts with comprehensive views of clients, policies, and claims. So employees and brokers can serve clients efficiently and easily grow relationships.

Use accurate, insight-ready data to fuel intelligent processes and analytics. Streamline self-service, quoting, underwriting, and claims settlement processes.

Simplify risk management and compliance with comprehensive data.

Simplify KYC, AML, and data privacy compliance with comprehensive and up-to-date profiles. And earn client trust by managing private data based on their consent.

Minimize risk with accurate, insight-ready data fueling your risk management systems—from pricing to fraud management. And use external data to help clients prevent losses and claims.

Share clean legacy system data with modern systems.

Enrich and share legacy client, policy, broker, and claim data with modern operational and analytical systems. Rapidly integrate critical policy and claims information to power mobile and digital services. Turn them into rich insights with analytics and AI solutions while sharing with brokers and ecosystem partners to fuel innovation.

Drive agility, innovation, and smart processes.

Reduce operating and infrastructure costs for achieving a single source of trusted data. Automate master data management and data quality monitoring so you can focus on innovation.

Easily modify MDM solution and rapidly connect your systems to respond to business demands. Support new offerings with partner collaboration, AI/ML, and telematics.

What our insurance customers

have achieved.

60%

Increased first-call resolution for greater customer experience

>$1M

Estimated upfront MDM platform TCO savings

40%

Projected growth in prospects via new data sources

10X

Increase in data steward productivity

Start your test drive

Sign up for a free 30-day test drive

Start using your Reltio for Insurance velocity pack so you can see how quick it is to get value from Reltio Data Cloud.

“The business is thinking about Reltio as a solution to customer data problems as opposed to MDM being a purely IT-driven platform, which was the case with the legacy MDM system.”

MATTHEW COOK,

Director, Enterprise Data Services, Empire Life

How we deliver.

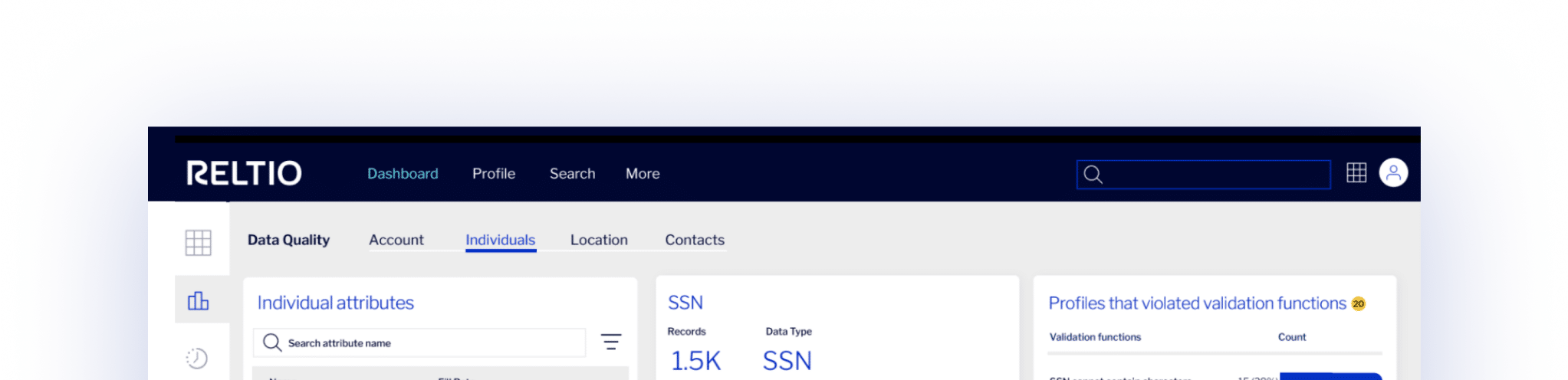

Trusted, interoperable, and high-quality data.

We unify and cleanse customer, policy, agent, and claims data in real time—including transactions and interactions. And enrich it with external data for an enterprise 360 view. We continuously monitor data quality without manual effort.

Designed for insurance. Fast time to value.

Our Reltio for Insurance solution includes an out-of-the-box data model and prebuilt configurations to activate insurance use cases. We help you instantly gain critical insights and simplify segment creation with automated householding.

Real-time integration. Easier than you might think.

Quickly integrate with new and legacy insurance suites, and analytics solutions in hours or days using prebuilt connectors in a low-code/no-code environment. Share legacy claim and policy data with modern systems using API-led integration options.

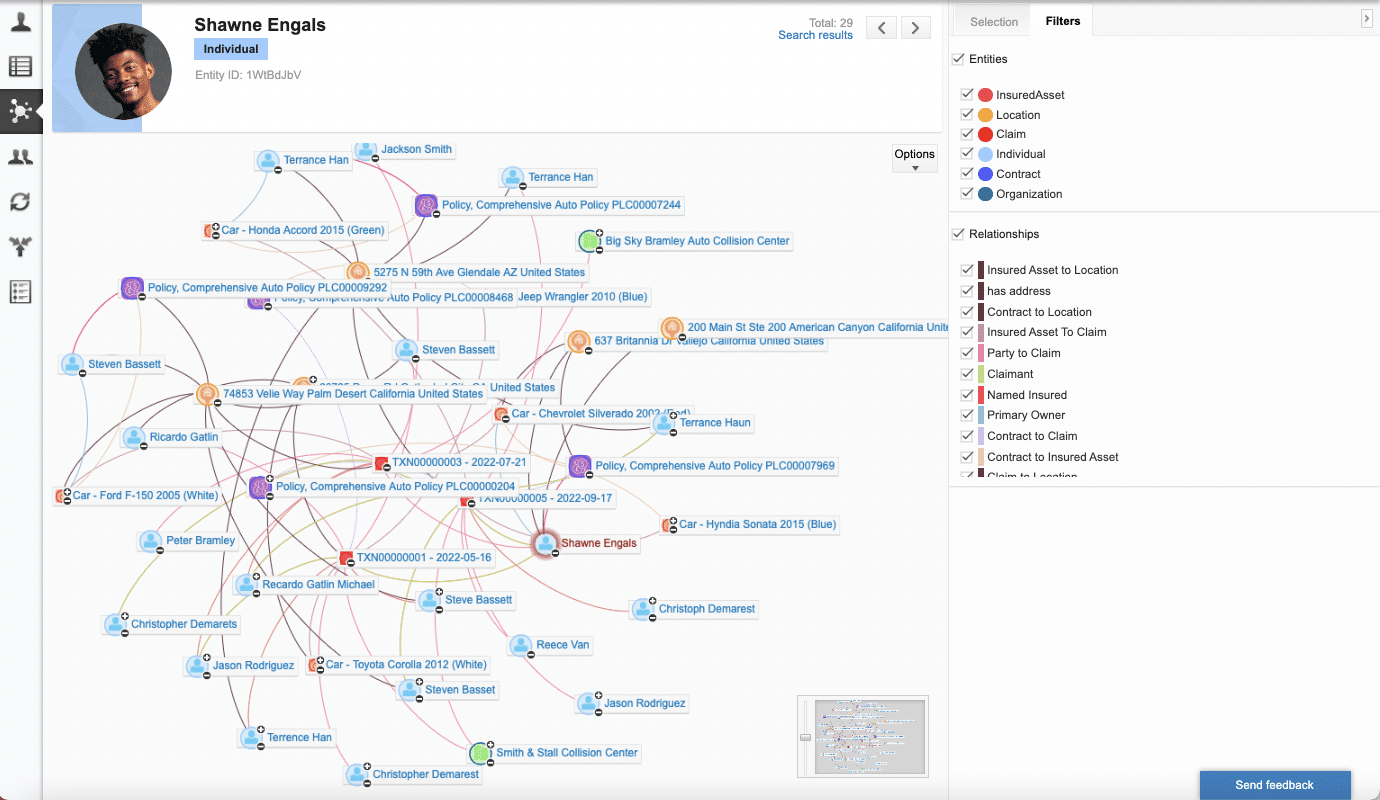

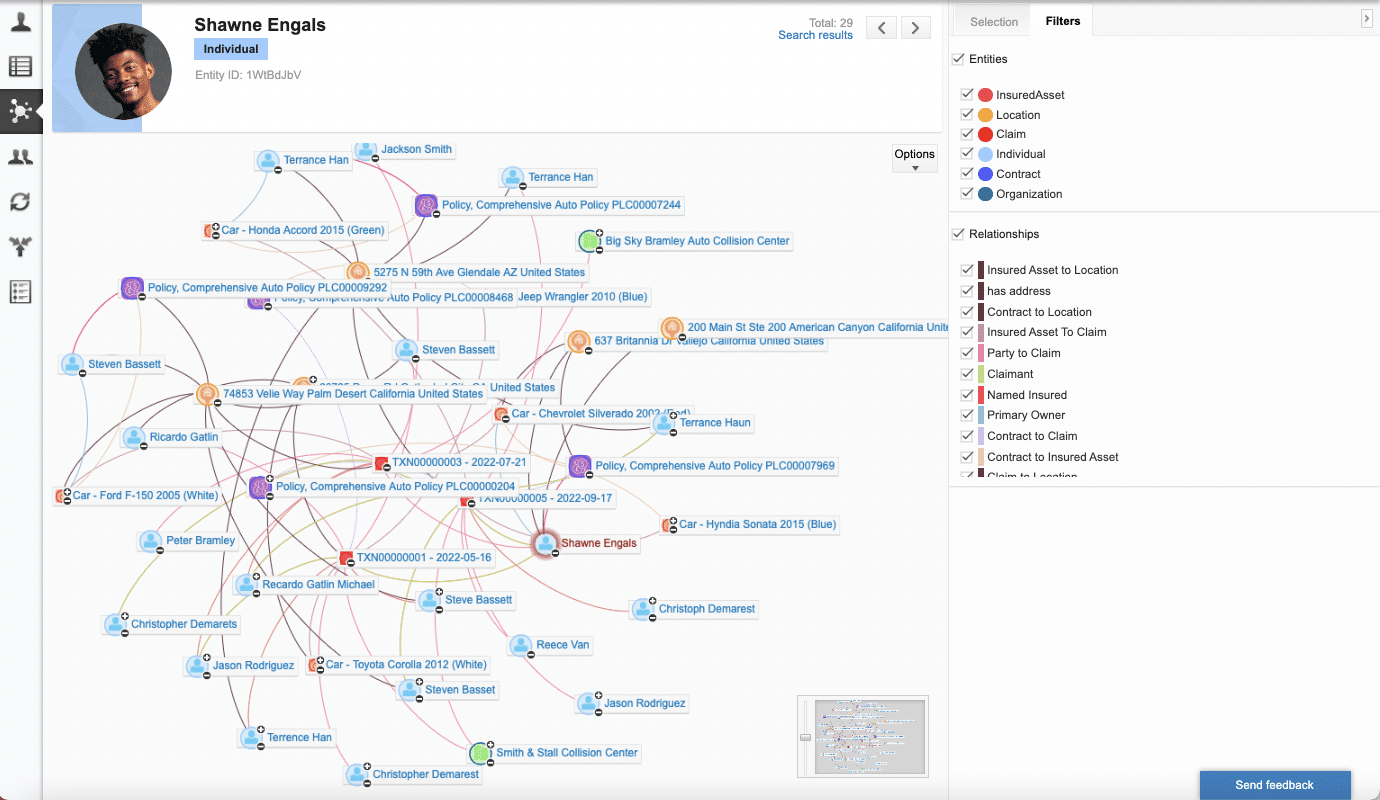

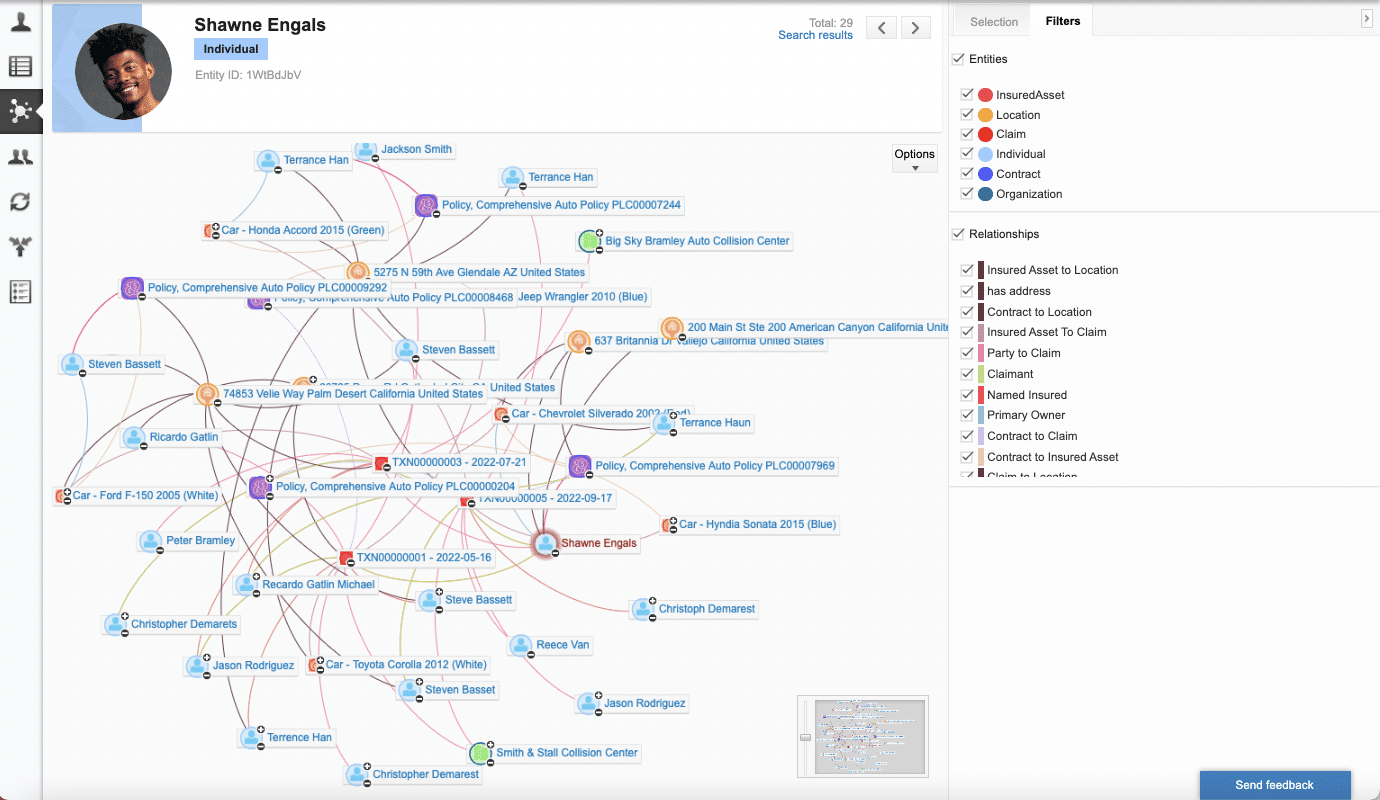

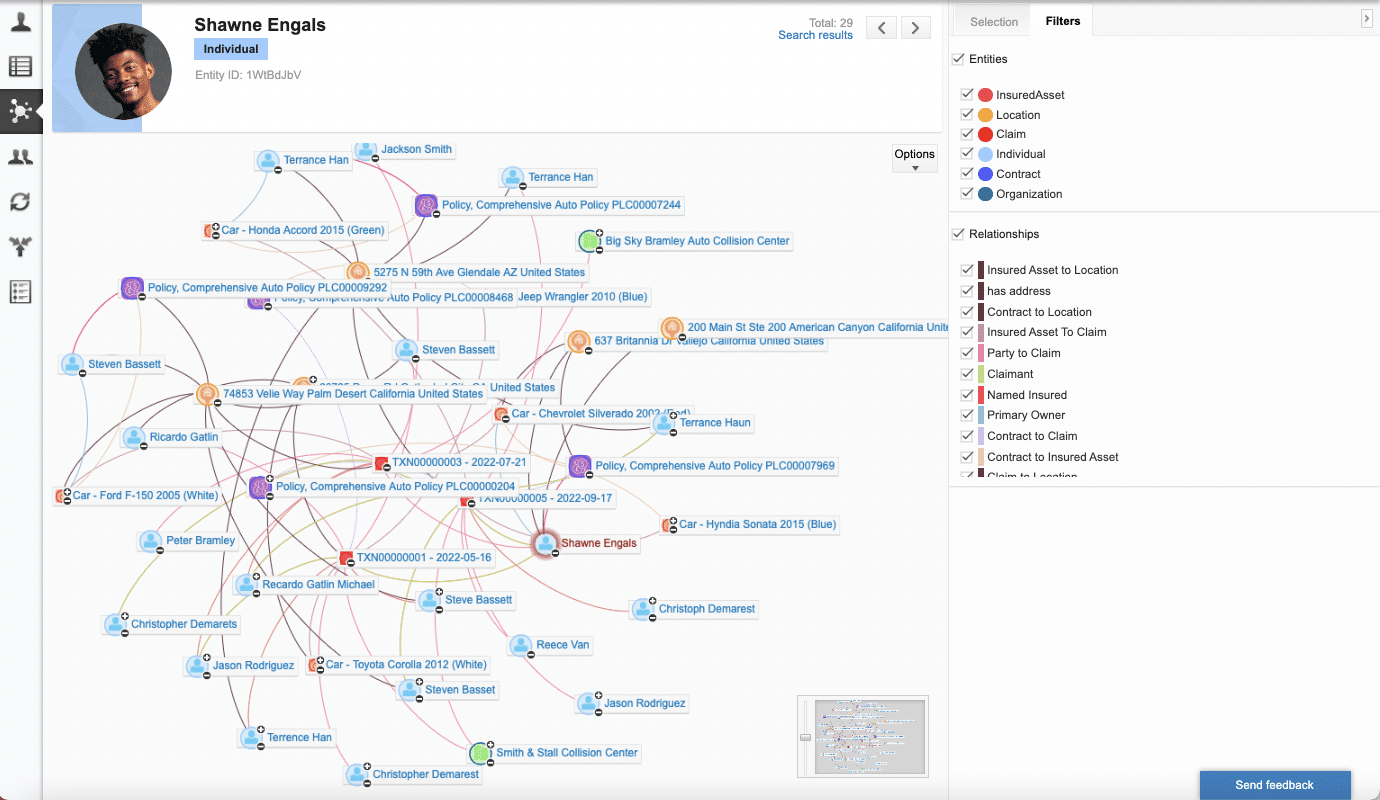

Relationship view with automated householding.

Graphically visualize and manage relationships among people, households, policies, claims, and locations using Connected Graph capabilities. So you can manage hierarchies for organizations and products as you increase cross-sell and upsell.

Ready to see it in action?

Get a personalized demo tailored to your

specific interests.