Trusted by leading banks and fortune 500 companies.

Deepen customer relationships and improve advisor productivity.

centricity.

efficiency.

integration.

and trust.

unlocked.

Drive omnichannel CX and AI-powered banking with trusted data.

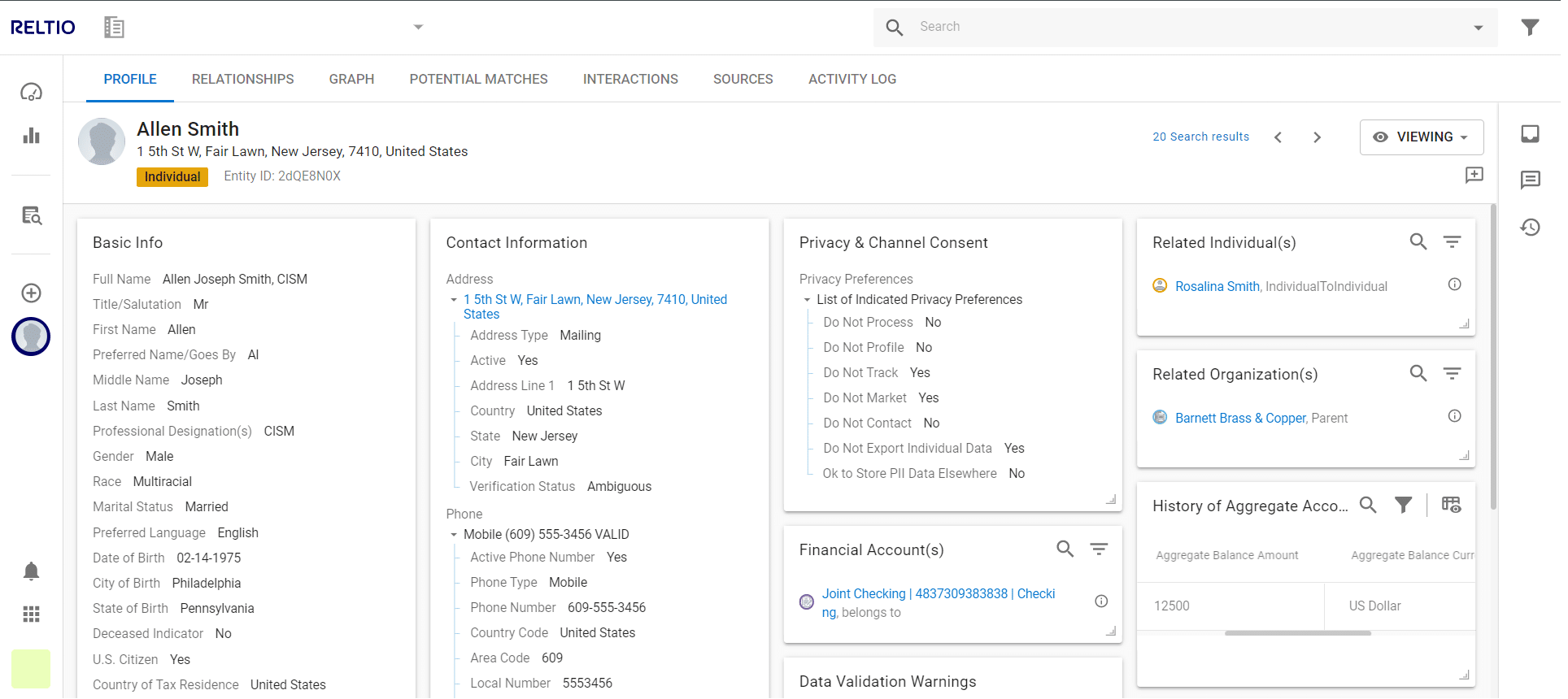

Consolidated, clean data across your enterprise allows you to understand your customers and present yourself as a single financial institution. Easily integrate with web and mobile systems to drive consistent digital experiences and boost marketing effectiveness. And streamline customer interactions with AI-powered initiatives such as chatbots and AI assistants.

Boost productivity with accurate, comprehensive data.

Using consolidated, enriched customer data from multiple sources enables you to enhance the productivity of your relationship managers and improve territory management.

With complete, real-time data and richer customer profiles, call centers, underwriters, and other employees are more effective and efficient.

Grow synergies with new acquisitions and partners.

Using consolidated, clean data enables easier integration with systems of acquired companies. So you can uncover new opportunities, grow operational efficiencies, and hit synergy targets.

And with ability to connect systems fast, you can collaborate easier with fintech partners to launch new products and services in a timely, efficient manner.

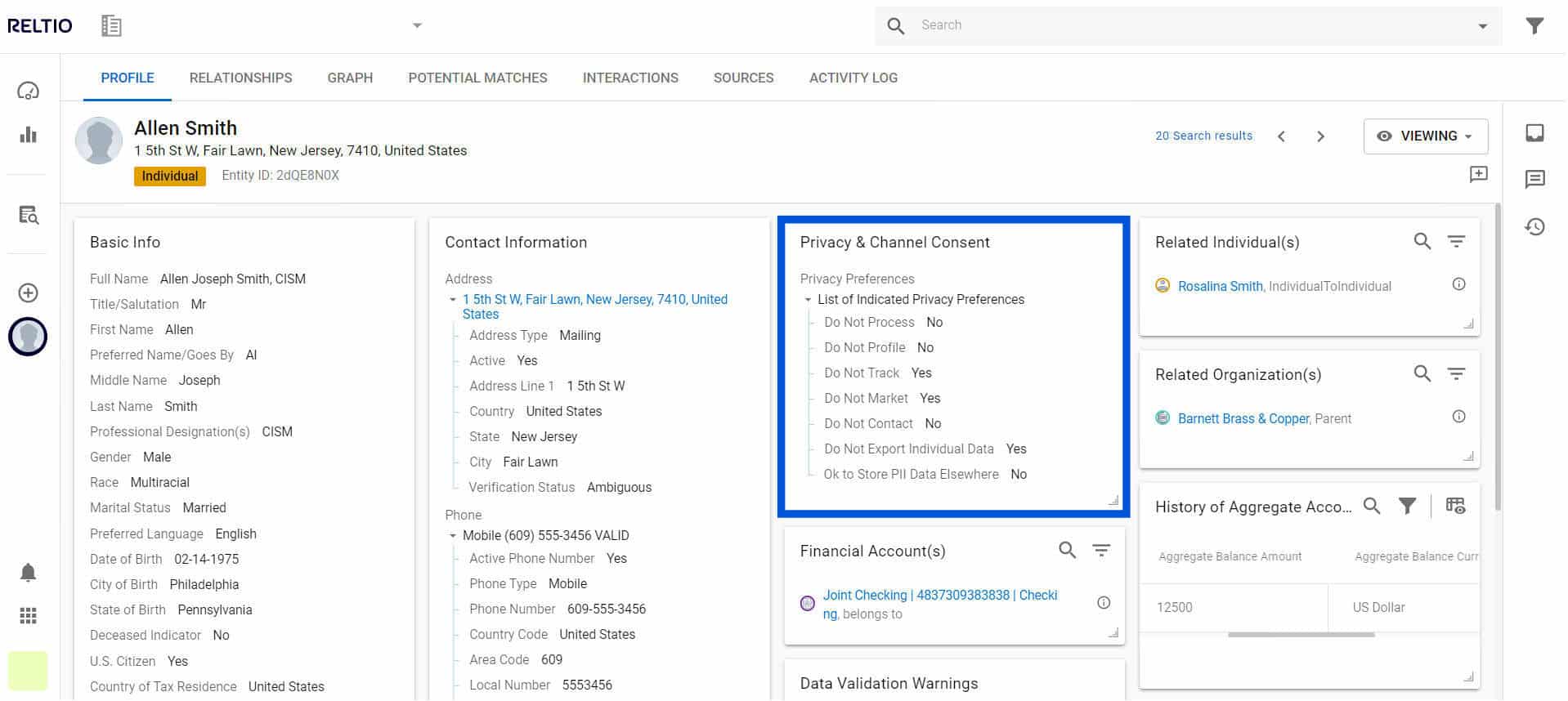

Simplify risk and compliance management with accurate data.

With unified, enriched, and standardized customer data made instantly available to operational and analytical applications, you can simplify KYC, OFAC, AML, and data privacy compliance. And earn client trust by managing private data based on their consent.

Align with open banking frameworks by providing secure, standardized API access to consumer financial data in near real time while maintaining data privacy.

Minimize risk with accurate, insight-ready data fueling fraud and risk management systems.

Share legacy system data with modern systems.

Integrate critical data from legacy banking and asset management systems with our API-led connectivity, prebuilt adapters, and no-code/low-code integration development. Simplify enrichment with external data and centralize the search of legacy client account data. And power your digital platforms and analytics solutions with real-time trusted data.

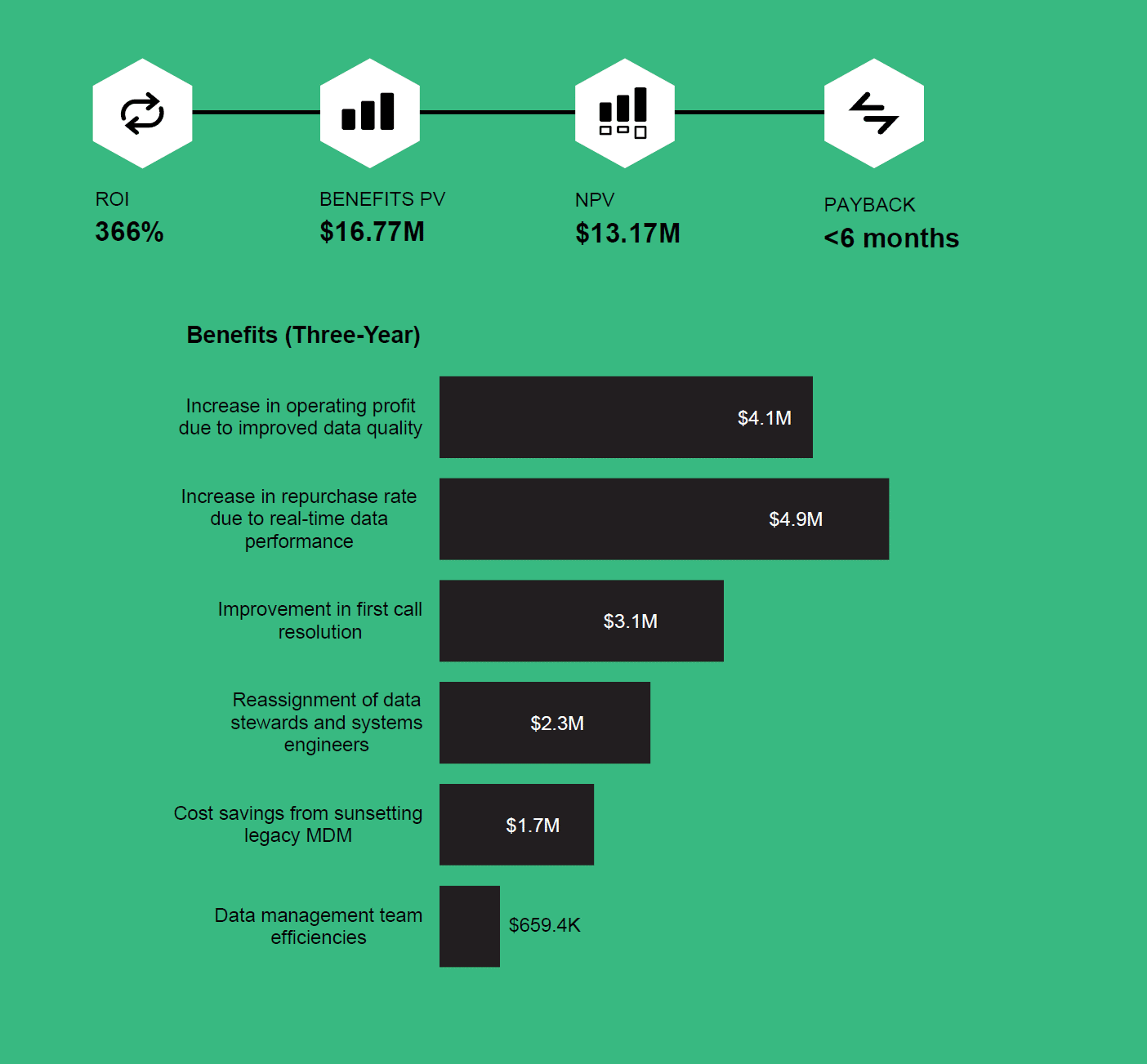

What our customers have achieved.

>$1M

estimated upfront MDM platform TCO savings

10X

sales rep productivity boost

60%

higher first-call resolution for greater CX

10X

increase in data steward productivity

How we deliver.

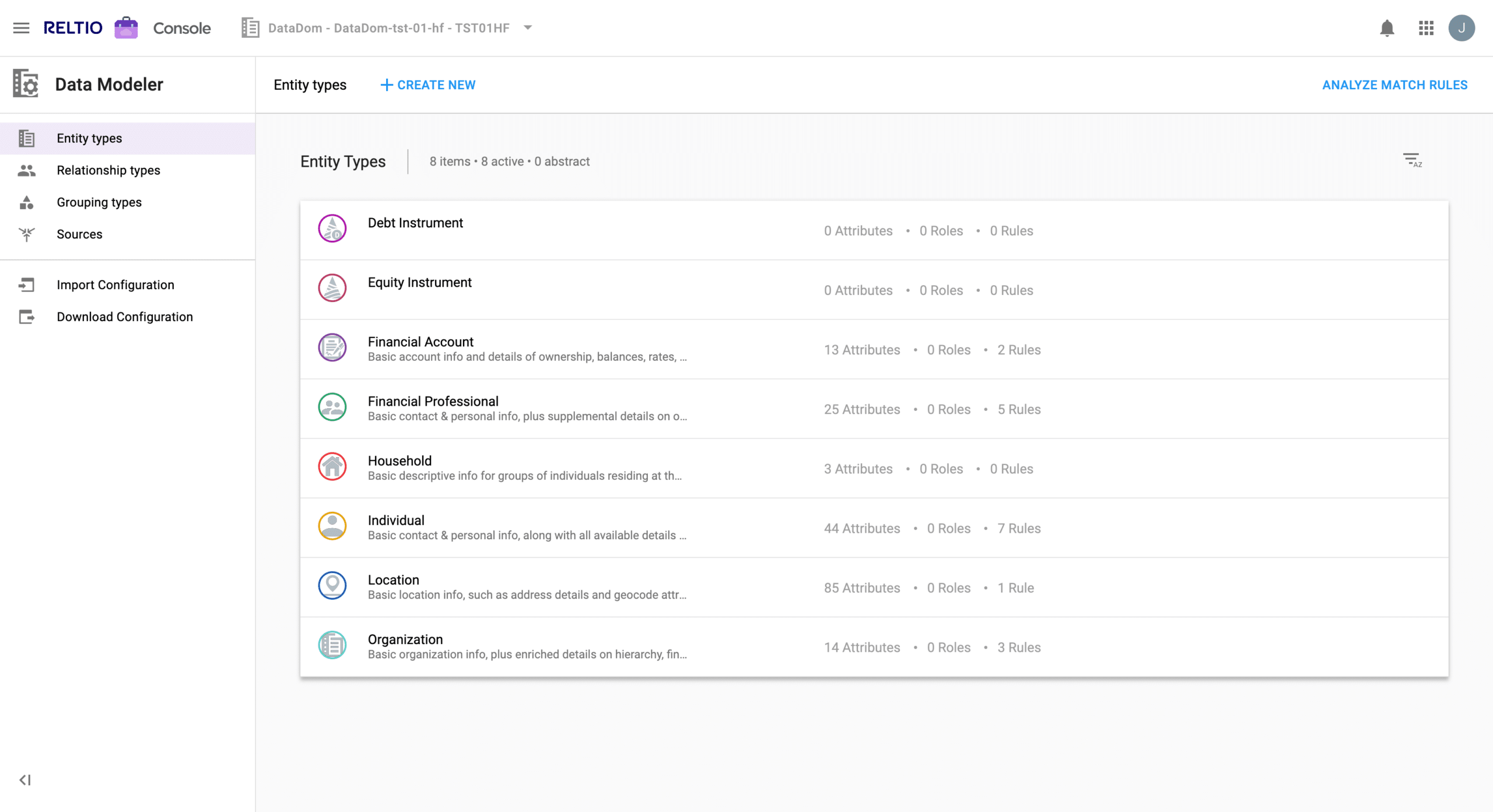

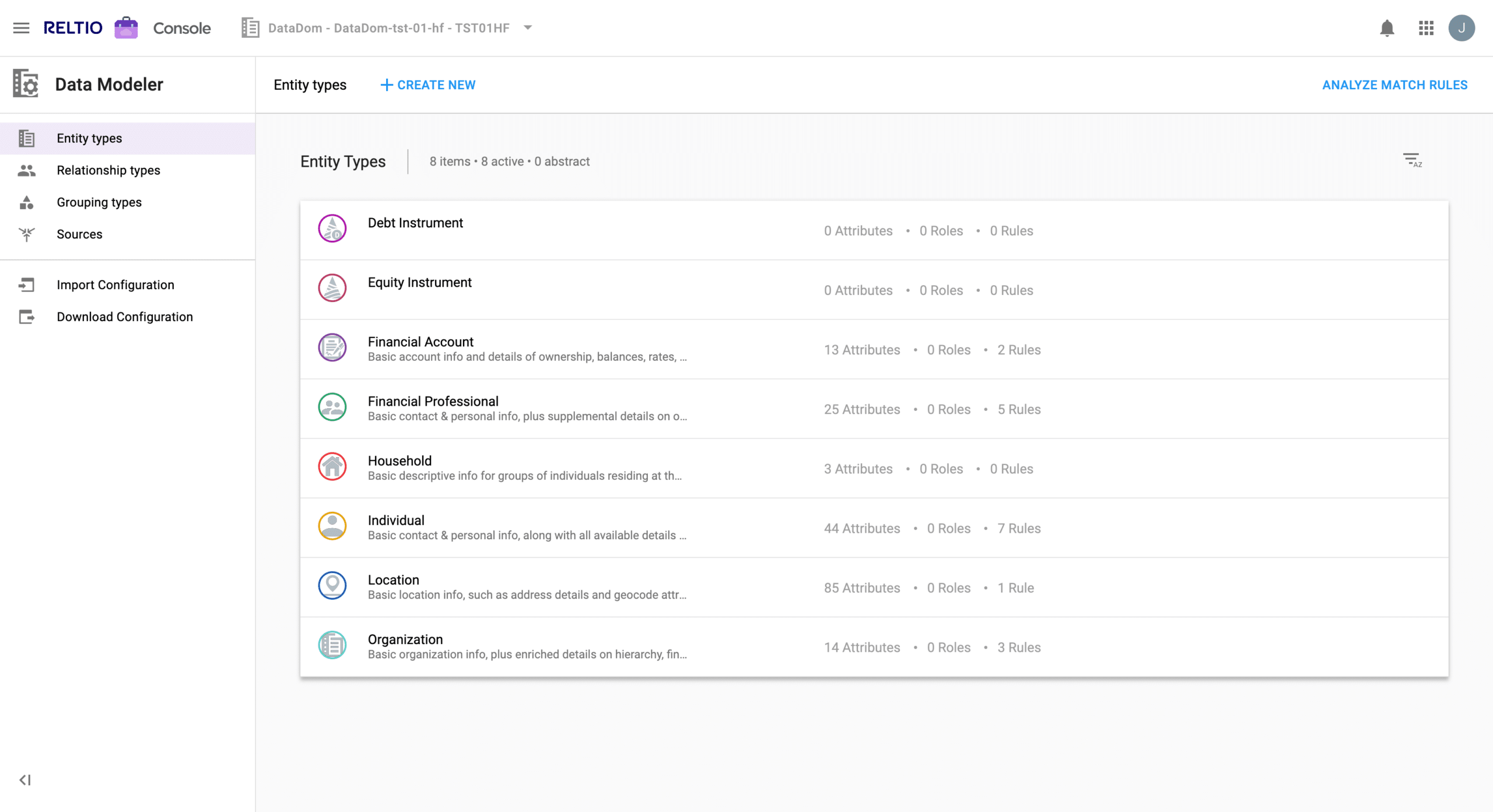

Designed for financial services companies.

Fast time to value.

Our out-of-the-box Reltio for Financial Services velocity pack includes a prebuilt data model for clients, financial accounts, households, and financial professionals. And configurations to activate banking and asset management initiatives.

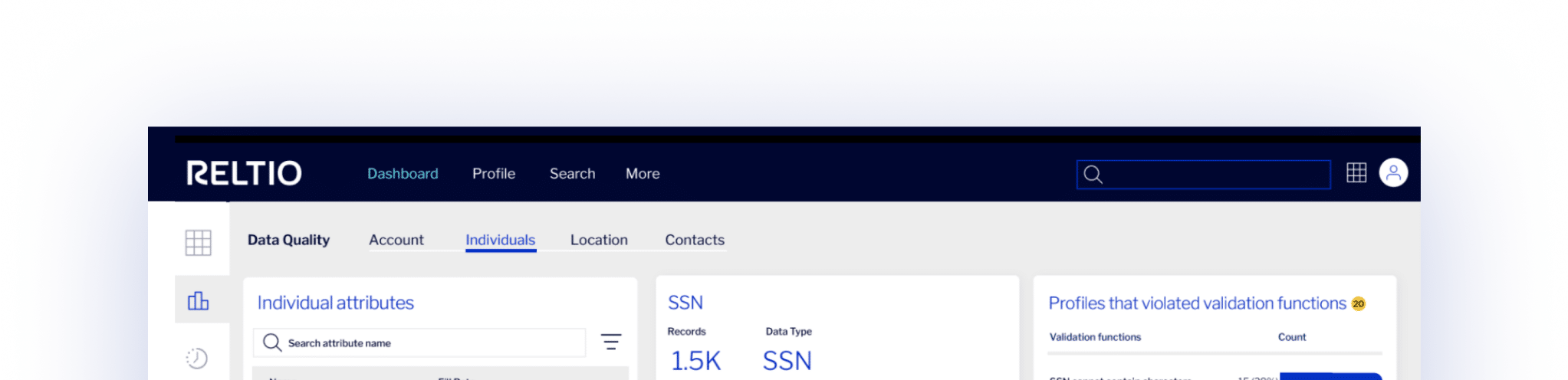

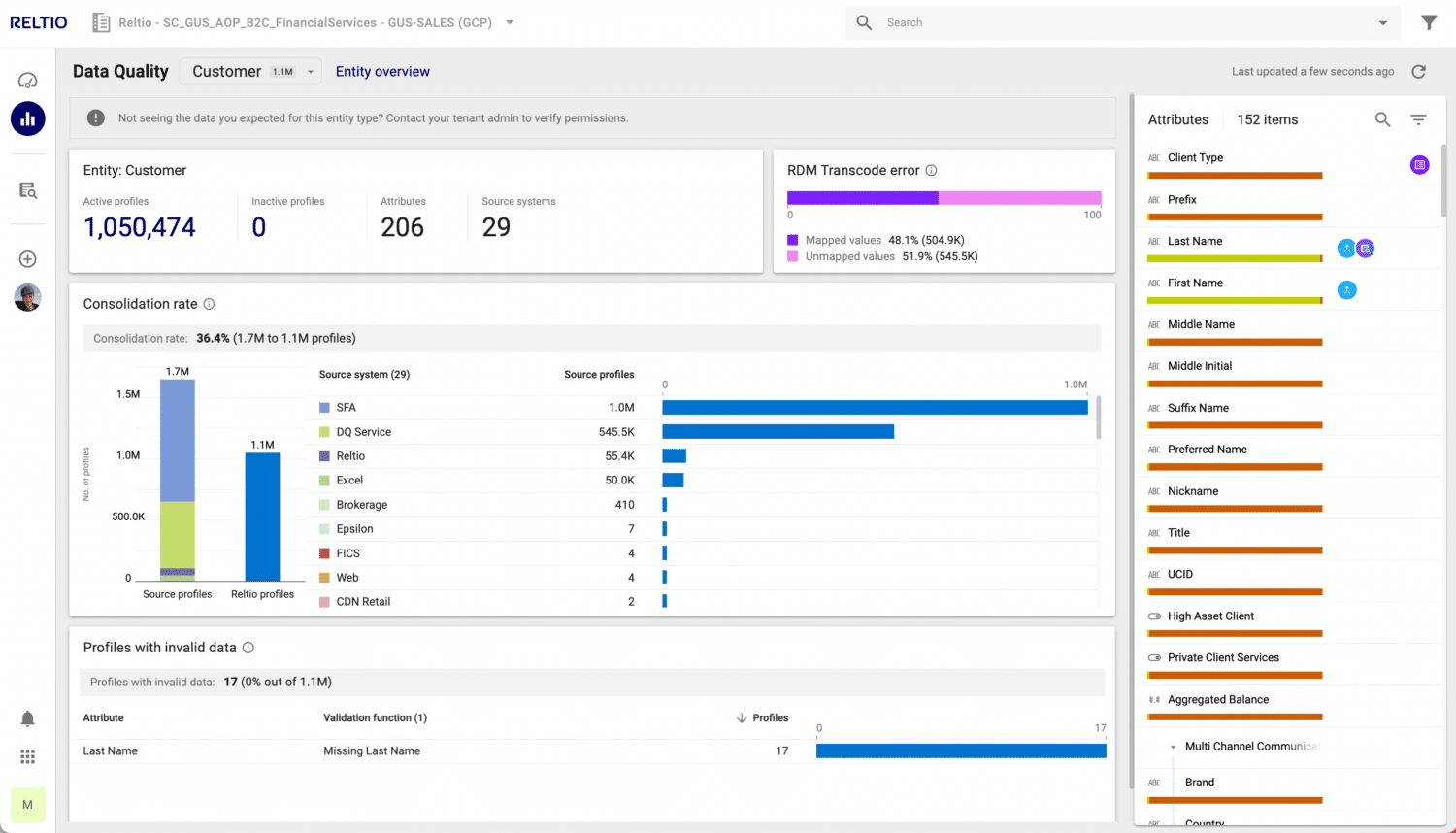

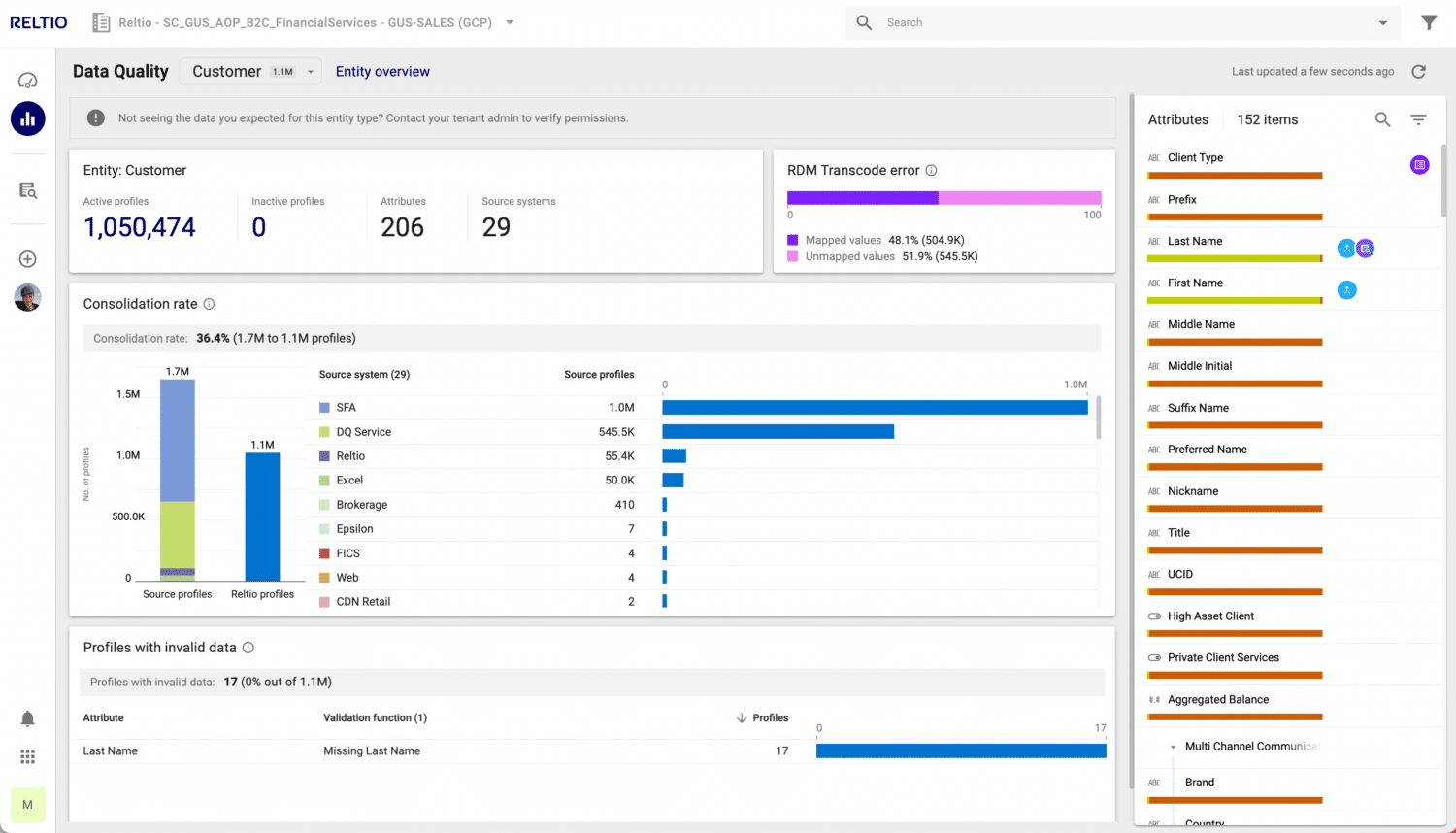

Trusted, interoperable, and high-quality data.

We collect, unify, and cleanse core data in real time—including transactions and interactions. And enrich it with external data for an enterprise 360 view. ML-driven capabilities continuously monitor data quality and identify critical issues.

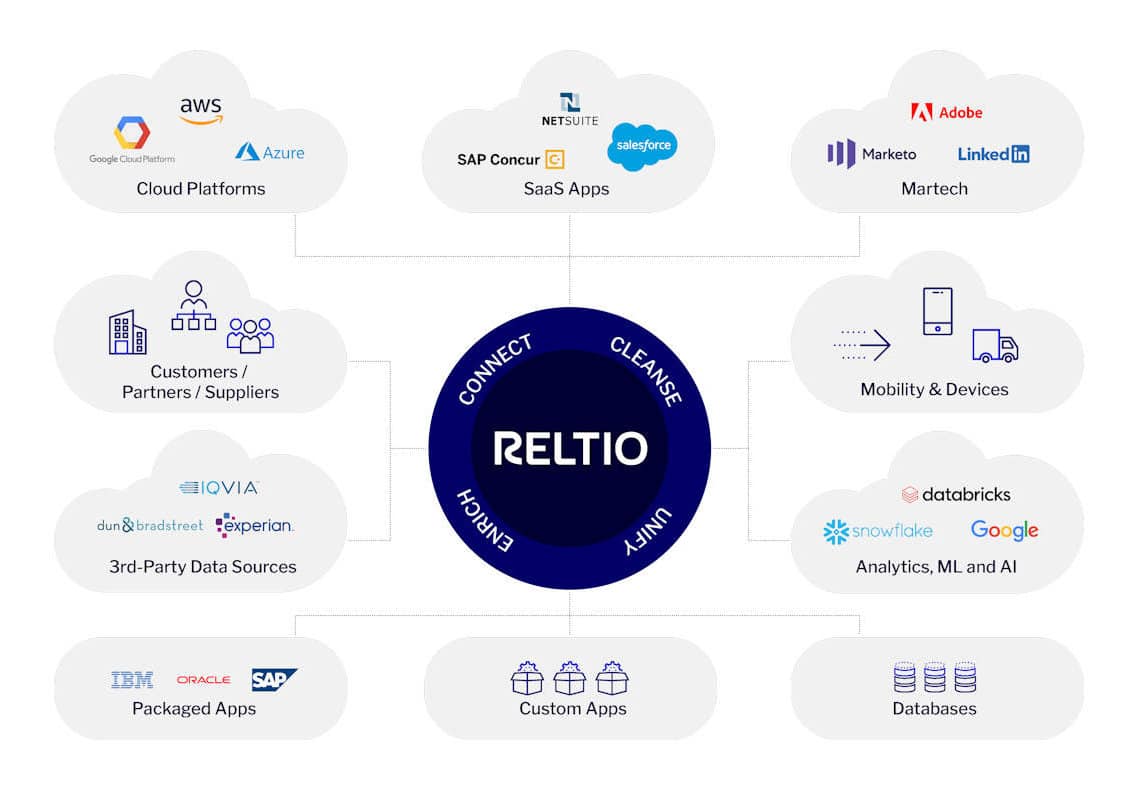

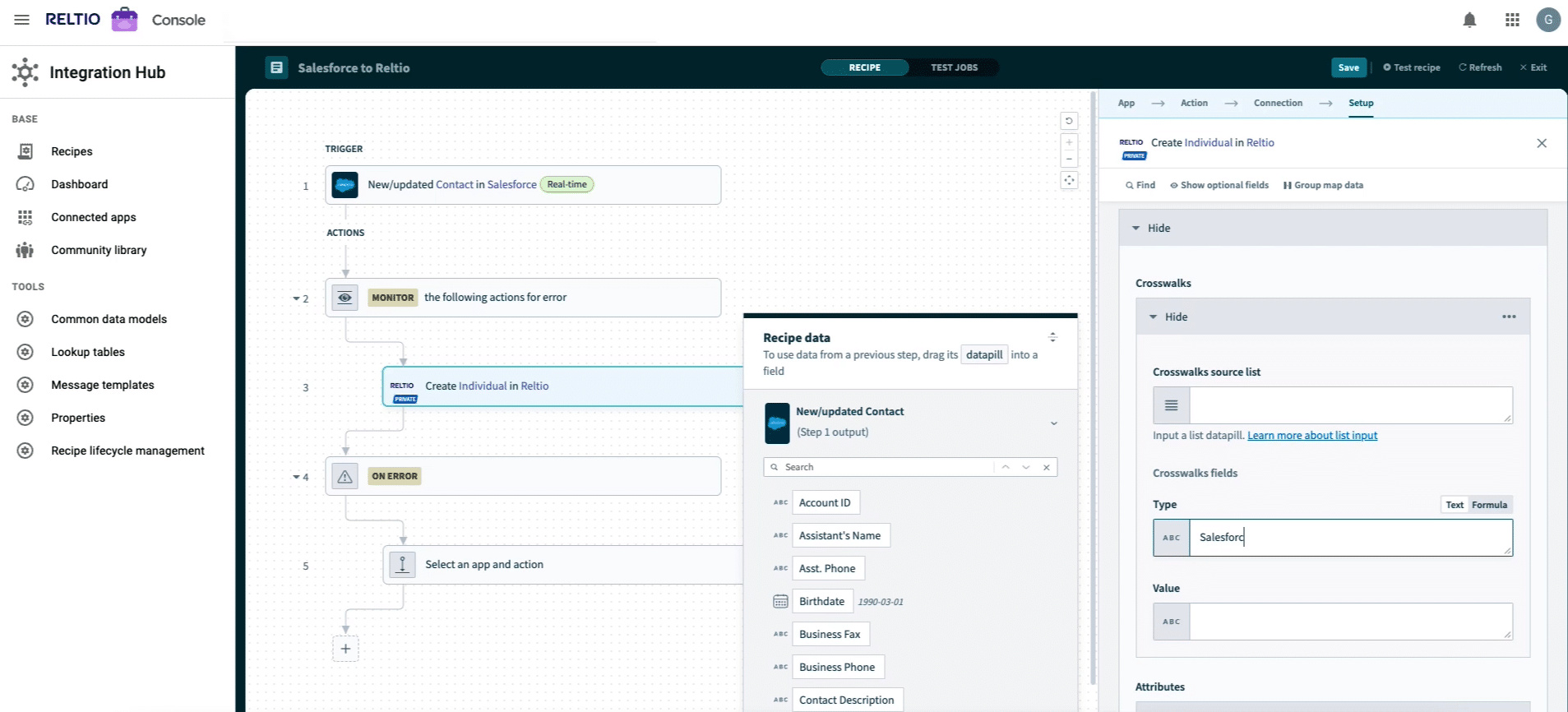

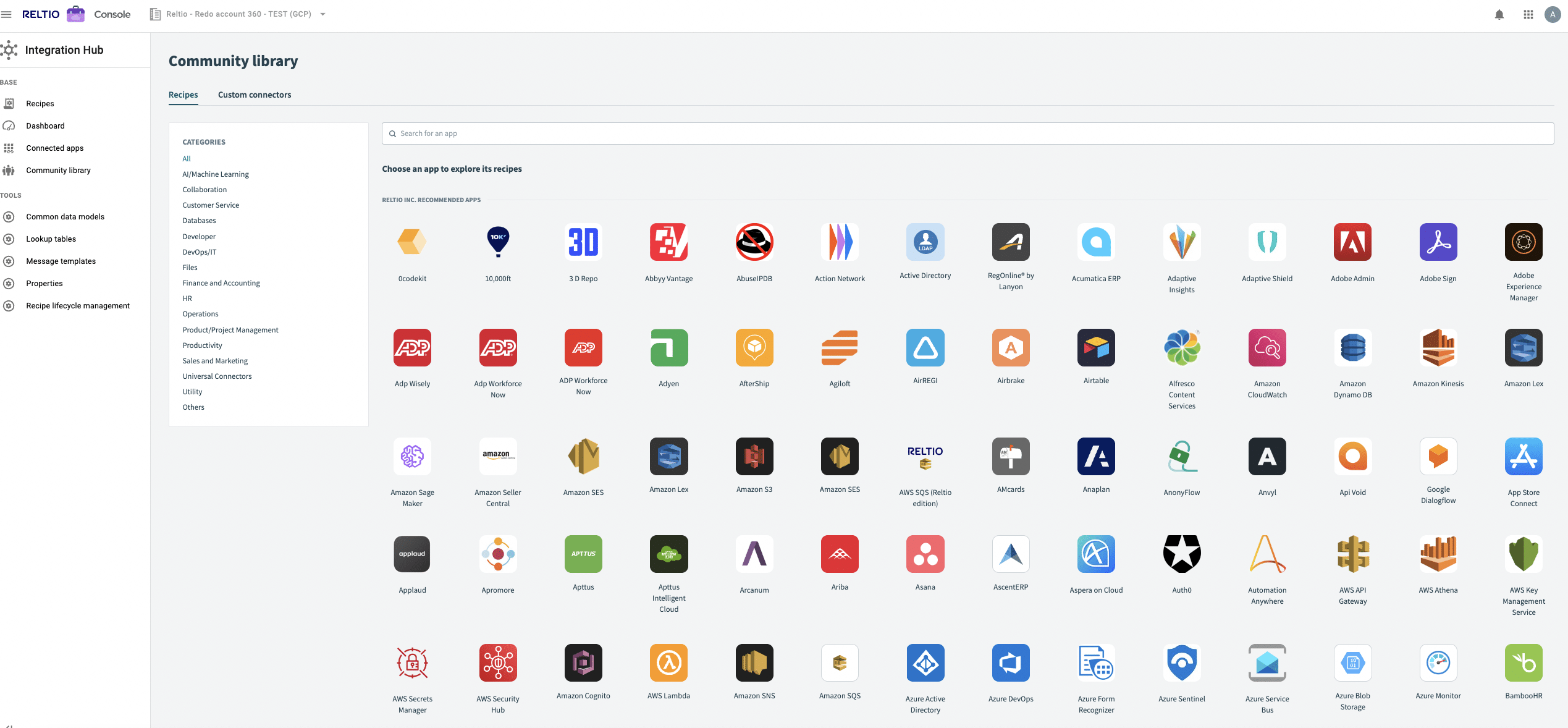

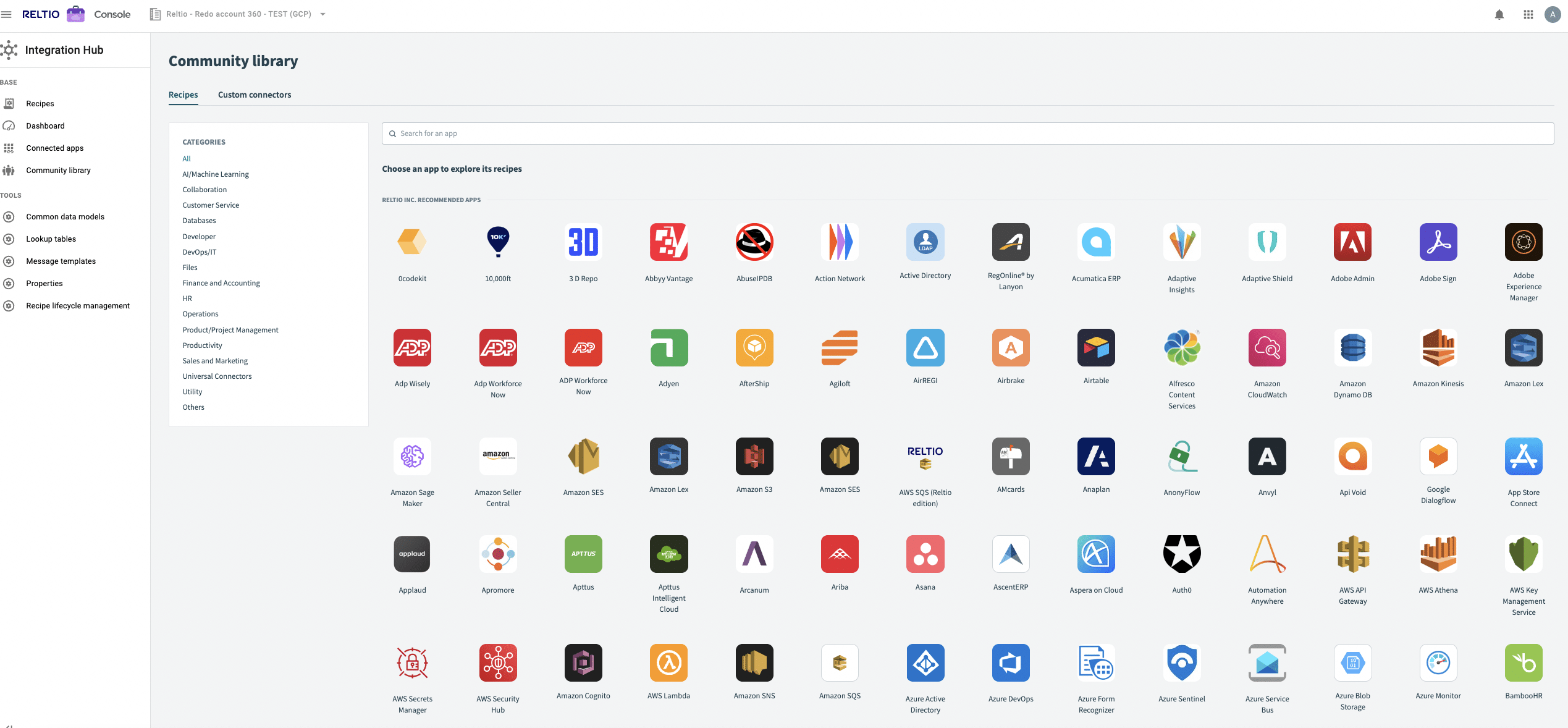

Real-time integration. Easier than you might think.

Quickly integrate with modern and legacy systems—and analytics solutions—in hours or days using prebuilt connectors in a low-code/no-code environment. Or use API-led integration options to share data across the enterprise, with fintech partners, and with the open banking ecosystem.

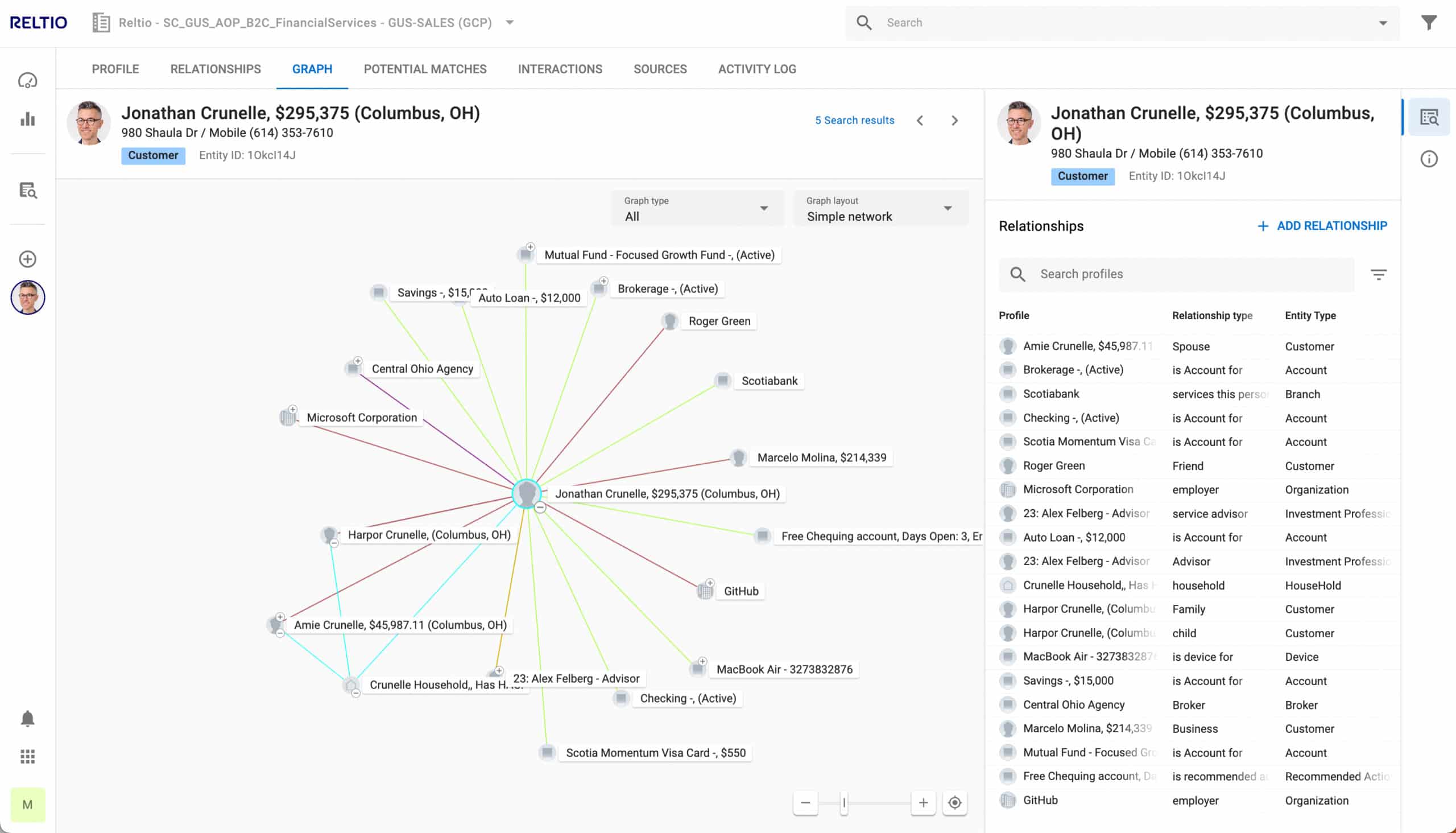

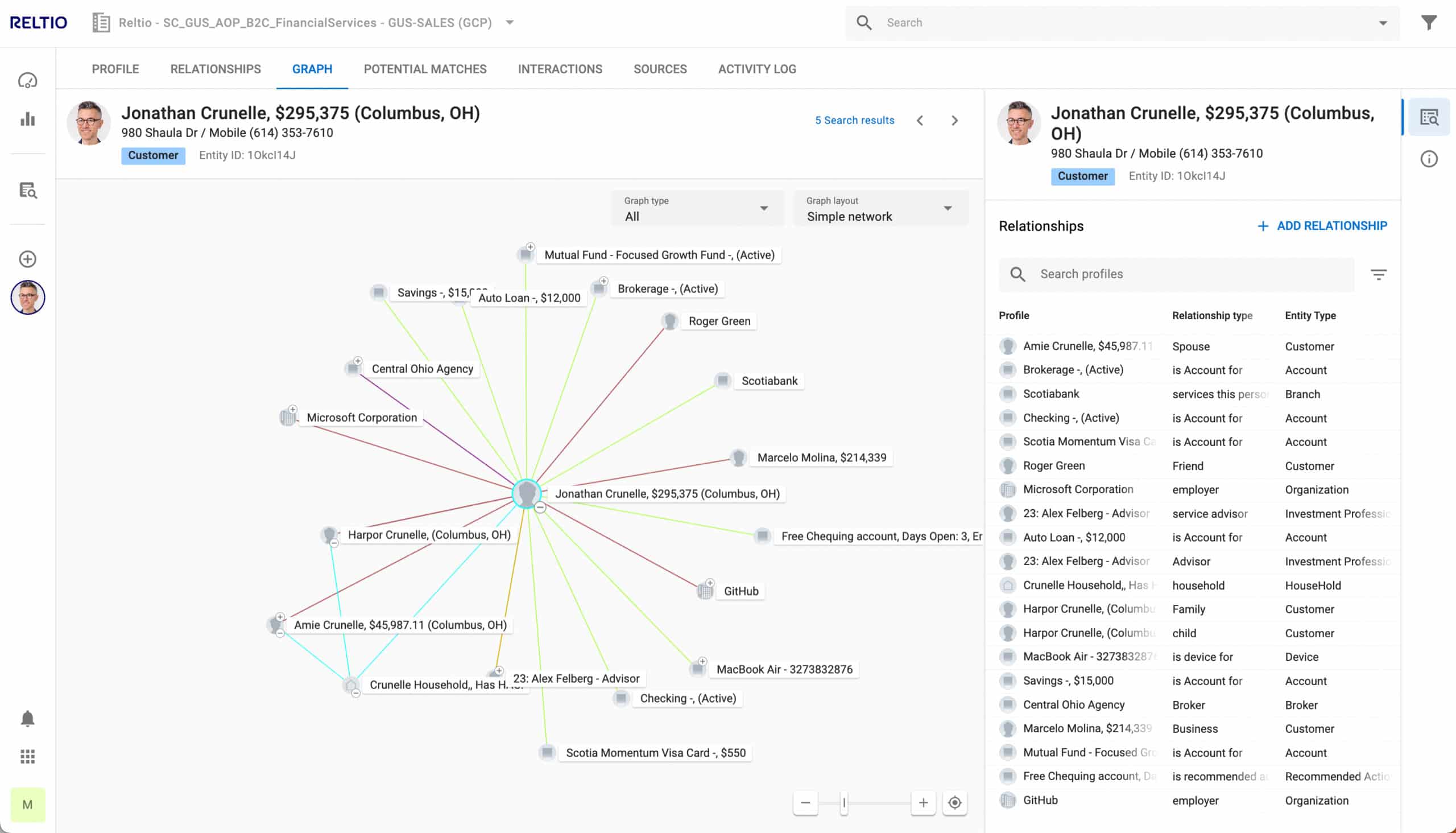

Relationship view with automated householding.

Visualize and manage relationships among people, households, accounts, advisors, and locations using graph technology. Manage hierarchies for organizations to increase cross-sell and upsell. And drive targeted campaigns during life events.

Power your AI and analytics

with trusted data.

We drive business value for a wide range of use cases.

retail banking.

wealth management.

banking.

- Deliver AI-powered omnichannel CX and seamless customer onboarding

- Improve operational efficiency and client service productivity

- Simplify compliance with KYC/KYB, FHLB reporting, AML, data privacy

- Enable AI-driven fraud analytics

- Increase client retention and growth with personalized insights, more effective advisors

- Enhance advisor productivity, client onboarding, back-office efficiency

- Improve credit risk management

- Simplify compliance with KYC/KYB, AML, data privacy

- Enable differentiated insights and consistent experience across asset classes

- Reduce costs via sales and employee productivity and efficient global operations

- Improve portfolio and credit risk analytics

- Simplify compliance with KYC/KYB and more

“Most banking is done via online and mobile channels, so we needed trusted data so we could confidently say, ‘we know you, you can trust us, and we are here to help you on your financial journey.’”

JAY FRANKLIN,

Senior Vice President of Enterprise Data and Analytics

Learn more about how we help financial services firms thrive.

Ready to see it in action?

Get a personalized demo tailored to your

specific interests.