Reltio Leadership Team

Reltio’s leadership team has a passion for helping Global 2000 companies power the experiences of the future with the data that matters most to their business.

We have deep expertise in SaaS, enterprise applications, master data management and big data stemming from leadership positions at Informatica, Siperian, VMware, PeopleSoft, Salesforce, Adobe, ServiceNow, NetApp, Citrix, Intuit, SAP, and TiVo.

Learn more about Reltio’s vision.

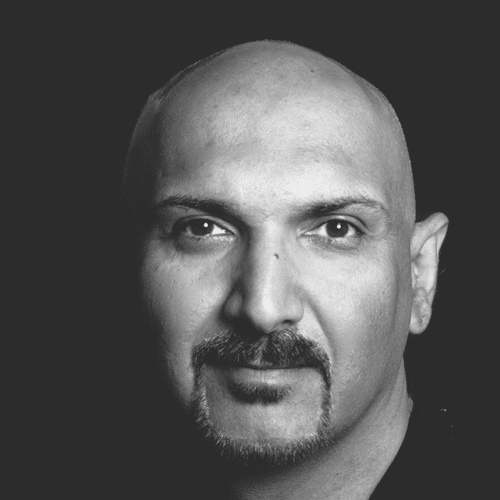

Manish is the Founder, Chairman, and CEO of Reltio, the first cloud-native, software-as-a-service (SaaS) data platform. An entrepreneur with a vision of the big-picture ways data can drive business and industry transformations, Manish founded Reltio in 2011 to help organizations accelerate the value of their data and deliver on business outcomes. Since its inception, Manish has led Reltio’s evolution from the concept stage to a high-growth company valued at $1.7 billion with more than $100 million in annual revenue. Manish previously led product strategy and management for the Master Data Management (MDM) platform at Informatica and Siperian. During his career, Manish has architected some of the largest and most widely used data management solutions used by most Fortune 500 companies today. Manish holds a bachelor’s degree in mechanical engineering from Andhra University College of Engineering.

Deanne is Chief Customer Officer of Reltio. She oversees and manages global professional services, customer engineering, customer success organizations, and the overall customer experience. Deanne has over 20 years of experience in data management. Before joining Reltio, she held key sales and leadership positions in professional services and customer success and engagement, accumulating extensive knowledge in developing and implementing customer-centric strategies. During her tenure at Reltio, Deanne has held leadership positions across functions, including alliances, product management, enablement, professional services, and customer success. Deanne holds a BS degree in Computer Information Systems from DeVry University.

Don Bulmer is Reltio’s Chief Marketing Officer, responsible for leading the marketing organization, including brand, demand generation, product marketing, and digital marketing. Don has over 25 years of experience driving impactful marketing strategies in both B2B and B2C sectors. He has held leadership roles at some of the world’s most influential companies, including Veeva Systems, AWS, Shell, Gartner, SAP, and several innovative Silicon Valley startups. Most recently, Don served as Vice President of Marketing and CM0 for Veeva Consumer Products, where he transformed marketing efforts—driving 200% growth, tripling the pipeline, and reducing sales cycles from years to just months. Earlier in his career, Don was Vice President and Executive Partner at Gartner, where he founded and scaled the company’s CMO advisory service, helping business leaders navigate digital transformation, market expansion, and customer success across diverse industries. Don holds a Bachelor of Arts degree in Communication from University of the Pacific.

Steve Debenham is Reltio’s Chief Legal Officer, responsible for overseeing all aspects of the company’s legal, governance and compliance functions globally. Prior to joining Reltio, Steve was Vice President and General Counsel for Telenav, an in-car commerce, navigation and infotainment company. He also served as Vice President and General Counsel at Aerohive Networks, where he helped lead the company from its initial public offering (IPO) to later sale to Extreme Networks. Steve has also held executive leadership roles at various other technology companies, including Silicor Materials, Asyst Technologies and Harris myCFO Inc. Steve was previously a partner with a Bay Area law firm, practicing IP litigation. Steve holds an A.B. degree in History from Stanford University and a J.D. degree from the University of California, College of the Law, San Francisco (formerly Hastings College of the Law).

Praveen Grover is Senior Vice President of Engineering at Reltio. Praveen leads the global Engineering teams and is responsible for platform engineering and Technology Operations. Praveen brings over 25 years of software engineering experience. Before joining Reltio, Praveen was Vice President of Reliability Engineering at Adobe. Before joining Adobe, he worked for Citrix for 18 years as Vice President of Engineering. He led engineering and operations for Sharefile, Podio, RightSignature, and the engineering teams for Netscaler and other core Citrix virtualization and security products. Praveen holds a Bachelor of Engineering in Electronics from Pune University in India.

Ansh Kanwar is Chief Product Officer (CPO) overseeing Reltio’s global software engineering, product management, and technology operations. Ansh has extensive experience in product management, software development, product marketing, security, cloud computing, and technology operations. Over the last 23 years, he has held numerous senior technical and management roles, including at Citrix Systems, where he served as Vice President, Technology Operations, and LogMeIn, where he served as Chief Technology Officer, and General Manager, Products and Technology at Onapsis. Ansh is a public speaker and loves discussing Data Unification and Management, AI in Data, Data Products, the Ethical use of Data, and building at scale SaaS products. He has a Bachelor’s in Computer Engineering from Delhi University, an MS in Electrical and Computer Engineering from the University of California, Santa Barbara, and an MBA from the MIT Sloan School of Management. He lives in Cambridge, MA.

Connie Puglia is Reltio’s Senior Vice President and Chief Human Resource Officer. In this role, Connie oversees all aspects of global Human Resources including Facilities. Connie’s expertise spans more than 20 years, and includes proven success designing and implementing global HR models and strategic plans that deliver measurable business results for rapidly growing, transforming, and disruptive companies. Prior to Reltio, Connie Puglia was TiVo’s Senior Vice President and Chief Human Resource Officer where she was responsible for global Human Resources including Real Estate and Internal Comms. Connie has also held global HR leadership roles at NetApp, Avaya, Zipcar, and Aspect Software, where she was responsible for talent acquisition, compensation, leadership development, strategic talent management initiatives and workforce analytics. Connie holds a B.S. in Management from Merrimack College in North Andover, Massachusetts.

James is Reltio’s Chief Financial Officer. He is responsible for overseeing global accounting, finance, tax, treasury, and IT. Prior to Reltio, James was with Payscale, where he served as CFO. James has more than two decades of strategic and operational financial experience at notable companies, including Workday, Morgan Stanley and Accenture. James received Bachelors and Masters degrees in Philosophy, Politics and Economics from the University of Oxford, and a dual MBA and Masters degree from the Wharton School and Lauder Institute at the University of Pennsylvania.

Scott Vandiver is a seasoned enterprise SaaS executive with over 20 years of experience driving customer success, building high-performing teams, and revenue growth. As Chief Revenue Officer at Reltio, Scott leads global revenue operations, empowering enterprise clients to unlock business value through cloud-native, AI-driven master data management solutions. Prior to joining Reltio, Scott held senior leadership positions at Informatica, SAP, and Agile Software, where he consistently delivered outstanding sales results and played a pivotal role in scaling business operations. He brings deep expertise in SaaS, data management, and enterprise software, with a proven ability to align sales strategy with evolving customer needs. Scott holds a Bachelor’s degree in Finance and an MBA from Auburn University. He is passionate about innovation, customer success, and driving data-driven growth.

Advisory Board

John Repko is a member of the Reltio Advisory Board. He has led technology strategy for some of the world’s largest enterprises. Most recently, he served as EVP and Global CIO at AIG. He has also served on the Boards of Blackboard Insurance and Bioclinica and was Global CIO at Johnson Controls. Currently, John is a member of the .406 Ventures Data + AI Executive Council, a Business Technology Advisor and a Professor at Villanova Business School, where, he brings decades of CIO-level expertise and enterprise transformation experience to investors, clients, and students.

Mihir Shah is a member of the Reltio Advisory Board. Mihir’s work is well known in Data Architecture and Engineering community but he also brings a wide variety of experience in technology, digital transformation and technology implementation in the Financial Services industry. Mihir served as the CIO/ Head of Data Architecture and Engineering at Fidelity Investments before retiring in March 2024. He was responsible for executing on an enterprise wide data strategy including Firm Master Data Management platform and a Firm Wide Data & Analytics Platform. Prior to this he was the Head of Technology Architecture Group at Fidelity and also served as the Chief Technology Officer for Fidelity’s Asset Management business where he architected and executed on a complete technology overhaul of the Asset Management Platform that manages over $4 Trillion. He has a Bachelors in Engineering and an MBA from University of Bombay.

Venkat Venkatraman is a member of the Reltio Advisory Board. He is Professor Emeritus at Boston University’s Questrom School of Business and a renowned expert on digital strategy and transformation. Author of two acclaimed books, he has advised leading companies on transforming their business to win in the digital era, and held professorship roles at MIT Sloan and the London Business School. His research and advisory work focus on how large firms reimagine their core capabilities in the age of data, AI, and digital ecosystems.

Abhi Yadav is a member of the Reltio Advisory Board. He is a serial entrepreneur at the intersection of AI, marketing, and data platforms. He is the Co-Founder and CEO of iCustomer, and previously founded Zylotech—the MIT spin-out customer-intelligence company (acquired) that powered growth-focused data operations for leading enterprises. He also co-founded the AI Innovators Community and Founders United. Abhi brings a unique perspective on automating intelligence and advises go-to-market and data leaders on building and scaling data-driven growth engines.,

Board of Directors

Manish Sood

CEO, Founder & Chairman

Manish is the Founder, Chairman, and CEO of Reltio, the first cloud-native, software-as-a-service (SaaS) data platform. An entrepreneur with a vision of the big-picture ways data can drive business and industry transformations, Manish founded Reltio in 2011 to help organizations accelerate the value of their data and deliver on business outcomes. Since its inception, Manish has led Reltio’s evolution from the concept stage to a high-growth company valued at $1.7 billion with more than $100 million in annual revenue.

Manish previously led product strategy and management for the Master Data Management (MDM) platform at Informatica and Siperian. During his career, Manish has architected some of the largest and most widely used data management solutions used by most Fortune 500 companies today.

Carla Stratfold

Former Vice President of Global & Strategic Accounts at

Amazon Web Services

Carla has a proven record of successfully scaling business operations and growing software revenue and margins at major global technology companies, including AWS, Oracle, and RealNetworks. She joined the Reltio Board of Directors in October 2021, immediately after retiring from AWS where she led the Americas Sales organization and Global & Strategic Accounts team responsible for supporting Fortune 200 companies through a period of rapid growth and expansion. Carla led Oracle’s Americas Product Sales and Marketing organization. At RealNetworks, she was the senior executive responsible for sales and distribution of technology and content services.

Jo-ann de Pass Olsovsky

Former CIO and Executive Vice President at Salesforce

A technology industry veteran and 14-year CIO, Jo-ann brings to Reltio’s Board nearly 40 years of technology experience. She served as EVP and CIO at Salesforce, overseeing the company’s global IT organization, including technology strategy, architecture, applications, engineering, M&A systems integrations, data/analytics, network infrastructure, cloud services, and enterprise operations. Jo-ann has earned numerous industry recognitions for technology achievements, including being named to the Computerworld Top 100 and Technology magazine’s 2021 TOP100 CIOs lists.

Jim Feuille

Partner, Crosslink Capital

Jim joined Crosslink in 2002, bringing 20 years of technology investment banking and management experience to the firm. Jim’s prior positions included global head of technology investment banking at UBS, where he built from scratch a powerful global technology investment banking practice; chief operating officer at Volpe Brown Whelan & Company, where he ran all aspects of the firm’s investment banking and brokerage operations and led the firm to record growth in revenue and market share prior to its acquisition by Prudential; and head of technology investment banking at Robertson Stephens, where he built the technology investment banking team into a leadership position in the industry.

Mike Gregoire

Co-founder and Partner at Brighton Park Capital

Prior to joining BPC, Mike served as Chairman and Chief Executive Officer of CA Technologies. Mike currently serves as a member of the Board of Directors of Advanced Micro Devices, and sits on its audit and governance committees. Previously, Mike was Chairman and CEO of Taleo Corporation, a leading cloud-based talent management software company that he oversaw going public before its successful sale to Oracle in 2012. With a career spanning more than 25 years in software and technology, Mike also served as Executive Vice President at PeopleSoft, from 1999 to 2004, and Executive Director at Electronic Data Systems, from 1988 to 1999. Mike is widely recognized as a strategic thinker in the information technology industry. He has been the chair of the World Economic Forum’s IT Governors Steering Committee, as well as a member of the Business Roundtable’s Information and Technology Committee. Mike also serves on the Executive Council of TechNet, an organization of CEOs that represents the technology industry in policy issues critical to American innovation and economic competitiveness. Mike earned a bachelor degree in physics and computing from Wilfrid Laurier University in Ontario, Canada, and an MBA from California Coast University.

Mark Templeton

Former Chief Executive Officer at Citrix Systems

Mark is the former president and chief executive officer of Citrix Systems, where he shaped the company for over 20 years, propelling Citrix as one of the world’s largest enterprise computing and software-as-a service companies. Under Mark’s leadership, Citrix transformed from a $15 million organization with one product, one customer segment, and one go-to-market path, into a global organization with annual revenues of over $3 billion and 100 million users worldwide. Mark also serves as a member of the board of directors at Arista Networks and Health Catalyst. Mark earned a bachelor’s degree in product design from North Carolina State University and an MBA from the Darden School of Business at the University of Virginia.

Sandy Smith

Former CFO at Segment

Sandy brings a unique blend of global financial, legal, and technology operating experience to Reltio as the company continues to grow and scale. Sandy currently serves on several boards of directors, and has held various financial leadership roles in the technology industry, including as CFO of Segment. Prior to Segment, she served as the Vice President of Finance at Twilio, and participated in various private and public financings, including its 2016 IPO. Before that, Sandy was with Akamai Technologies in various finance roles. She began her career as outside counsel for public companies on SEC matters before shifting focus to advise emerging, venture-backed technology companies.

Mike Gustafson

Executive Chairman at Druva

For more than 25 years, Mike has served in executive leadership and management roles across infrastructure and software companies – public and private, startups and established companies – as well as high growth businesses. Today, Mike is the executive chairman at Druva, an enterprise SaaS platform for data protection across data centers, cloud applications and endpoints. Mike is also a member of the boards of directors at Matterport, PDF Solutions and Everspin. Among his deep operational and leadership experience, Mike was senior vice president and general manager of Western Digital’s Flash Platforms Business. Before that, Mike served as CEO and chairman of Virident Systems (acquired by Western Digital). He also led BlueArc Corporation as CEO and board member, which was acquired by Hitachi Data Systems. Mike led worldwide sales, marketing and services over a six-year career at McDATA, which went public in 2000 and grew to more than $450M in revenues during his sales leadership. Early in his career, Mike served in various marketing and sales roles at IBM.

Tom Bogan

Former Vice Chairman at Workday, Inc.

Tom brings several decades of executive and leadership experience to Reltio, recently serving as Vice Chairman of Workday, Inc. (NASDAQ: WDAY), a leader in enterprise cloud applications for finance and human resources. While previously CEO of Adaptive Insights, a cloud-based software platform used by businesses to plan their operations, Tom negotiated the 2018 company sale to Workday in a cash deal valued at $1.55 billion. Bogan was a partner at Greylock Partners and board member at leading enterprise software and cloud companies. These include chairman positions with Citrix Systems and Apptio, and board member roles with PTC, Rally Software, Acquia, and many other SaaS software companies.

Board Observers

Graham Brooks

Partner, .406 Ventures

Graham leads data and cloud investing for .406 Ventures, focusing on highly disruptive, deep tech companies in the data stack, AI and cloud enablement space with a specific focus on healthcare and financial services. Graham has been at .406 Ventures since 2007, and in addition to investing runs the firm’s college outreach program.

At .406 Graham has led and been involved on the boards for 20+ investments including: Abacus Insights, ChaosSearch, ClosedLoop, Corvus Insurance, indico, Gamalon, Linea, Promethium, Reltio, and Simon Data. Exited companies with previous involvement include: AbleTo (recapitalized by Optum), AdTuitive (acquired by Etsy), Compass (NYSE: COMP) and Digitalsmiths (acquired by TiVo).

Prior to .406 Graham was an engineer and DBA at ALK Technologies, Cofounder and Head of Sales at Accentus and BizDev/Corp Dev for Bose Corporation. Graham holds an MBA from the Tuck School at Dartmouth where he was a Tuck Scholar and an engineering degree from Princeton University where he majored in computer science.

Liam Donohue

Founder, .406 Ventures

At .406 Ventures, Liam leads all healthcare investments focusing on early-stage companies that offer systems, technologies and services that support clinical delivery. He also teams up with Graham on .406’s data and analytics investment practice, as well as overseeing fundraising and other .406 firm responsibilities.

Liam has spent the past two decades as a venture investor, but he is perhaps most proud of his entrepreneurial activities – founding/co-founding four successful businesses, including two venture capital funds.

He started his career as a Principal at Foster Management, a venture investor focused on service industry investments; then co-founded Arcadia Partners, a fund focused on technology-enabled education companies; and finally, co-founded .406 Ventures with Larry and Maria. Over this time, Liam has invested over $130M of capital in 21 investments.

Liam earned a BS in Chemistry from Georgetown University and earned an MBA from Dartmouth’s Tuck School of Business.

Samantha Wang

Co-Founder and Partner, RPS Ventures

Samantha is a co-founder and General Partner at RPS Ventures, a later stage venture capital firm, focused on investing in revolutionary technology companies led by exceptional teams. RPS helps high-growth companies navigate today’s global environment, with access to a key network of some of the world’s most successful entrepreneurs.

Prior to co-founding RPS, Samantha was a Partner at Crosslink Capital, a venture capital firm based in Silicon Valley. Prior to Crosslink, Samantha spent 10+ years as a marketing leader, and was an executive at LegalZoom, the leading provider of online legal services. Earlier in her career, Samantha was a venture investor at 3i Group, and an investment banker at Deutsche Bank. Samantha holds a B.A. in Economics from Stanford University.

Ankit Sud

Principal, NewView Capital

Ankit joined NewView Capital as a founding member in 2018. With over $2.2 billion in assets under management, NVC pairs flexible capital with operational excellence to build enduring, industry-defining companies.

At NVC, Ankit helps build and support the firm’s portfolio through his focus on SaaS and fintech. He serves on the Board of Directors for Canopy and is a Board Observer for Reltio, GumGum, Human Interest, and MindTickle.

Prior to NewView, Ankit was an investor at General Atlantic, a global growth equity firm. Before joining the investing world, Ankit worked in investment banking at Qatalyst Partners and with FlexiLoans, an early-stage fintech company. Ankit earned an M.A. in Finance and a B.A. in Economics from Claremont McKenna College.

Steve Abbott

Partner, Sapphire Ventures

Steve is a partner at Sapphire Ventures, where he is responsible for the firm’s capital markets activities. Steve’s areas of technology focus include vertical and horizontal applications software, as well as businesses at intersection of next gen media, digital commerce and disruptive technologies. He has served as a board director for Recommind, board observer for Tonal, and currently serves as a board director or observer for Catchpoint, Fevo, OpenX, Project44, Reltio and Intelligent Brands. Steve is a founding partner of the firm’s early-stage sports, media and entertainment technology investing initiative, Sapphire Sport. Prior to joining Sapphire Ventures, he was a managing director in technology investment banking at Deutsche Bank, UBS and Jefferies, where he led more than 100 financings and M&A transactions.

Earlier in his career, Steve was a strategy consultant at Bain & Company and worked in technology corporate finance at Robertson Stephens. He earned his undergraduate degree from the University of California, Berkeley, with highest honors, an MBA from Stanford Graduate School of Business and a JD from Stanford Law School.